Should I apply for a Child-in-Care Benefit?

According to the Social Security Administration:

"A widow or widower, any age, with a child younger than age 16, gets 75 percent of the worker’s benefit amount."

This is called a child-in-care survivor benefit. If you are caring for a child younger than age 16, you can apply for a survivor benefit paid directly to you.

The question is, should you apply for this benefit?

Well, lots of factors go into whether it’s a good idea to claim a child-in-care benefit so let's break it down.

You can claim a child-in-care benefit if you care for children under age 16.

You are taxed on your child-in-care benefit earnings because this is paid directly to you under your social security number.

You can work and claim this benefit, but you're subject to an earnings limit. In other words, there is a cap to how much you can earn while working and still receive full benefits. You can check this link here for info on the current year's limits.

Once the child reaches age 16, the child-in-care benefit stops.

While working and receiving a child-in-care survivor benefit could mean a higher benefit for you and your family, if can also mean the opposite if you're able and/or willing to earn more than the applied earnings limit.

You see, the SSA limits the amount of money it can pay to a family. Remember the Family Maximum Benefit or FMB? (if not, revist the Social Security Numbers You Need to Know lesson).

The FMB limit can range from 150 to 180 percent of the deceased's full benefit amount. The calculations are complex (if you really want to know how it's calculated, click here), but the bottom line is if the total amount payable to all family members exceeds the FMB limit, each person’s benefit is reduced until the total amount equals the maximum allowed.

Confused?

Well, it's like this:

If you take a child-in-care benefit and you have two or more children, you'll likely be very near or reach the FMB limit.

And if you claim the child-in-care benefit for yourself, it could reduce your children's benefit (depending on how many family members are claiming benefits)

And you'd be limited to what you can earn elsewhere

If you are willing and able to work and can or do earn more than the child-in-care benefit earnings cap, you might want to consider either not applying or removing your application for child-in-care survivor benefits and earning more money on your own.

Some widows get tripped up on the idea that they're leaving free money on the table, but if the child-in-care benefit limits your earning potential, then it's not always a good idea. Or if your childrens' benefits reach or are close to reaching the FMB, why apply for the child-in-care benefit? All it will do is redistribute the money, no necessarily give you any more.

Let's look at an example of two fictitious families.

Let's assume the full benefit amount is $2,300 and the FMB is $3,450 (or 150% of the full benefit amount) for this family.*

*These are general/approximate numbers for the purposes of this example. I'm not a SSA rep and I don't play one on the Internet.

______________________________________________________________________________________

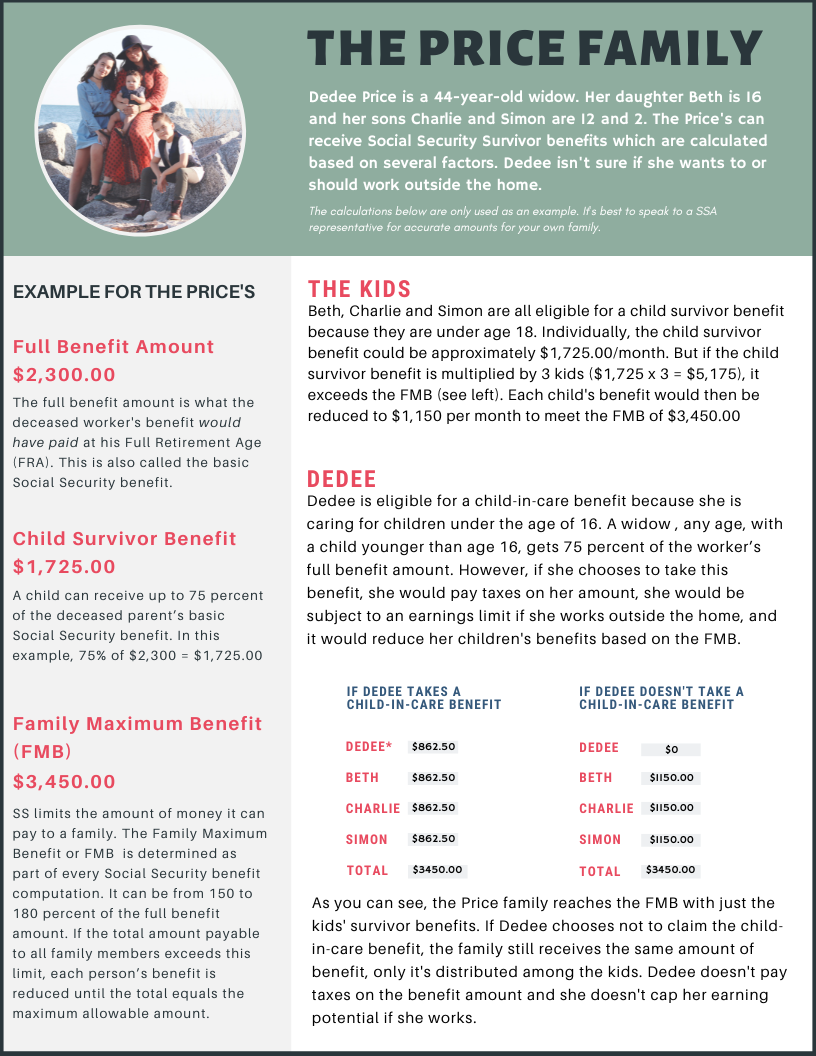

Dedee Price is a widow with three kids.

Each child is eligible for a child survivor benefit because they are under age 18. Individually, the child survivor benefit could be $1,725.00/month (a child gets 75 percent of the worker’s benefit amount so $2,300 x75% = $1725.00).

But if the child survivor benefit is multiplied by 3 kids ($1,725 x 3 = $5,175), it exceeds the FMB (in this example, we're using the FMB cap of $3,450).

Each child's benefit would then be reduced to $1,150 per month to meet the reduced FMB of $3,450.00.

Now Dedee is eligible for a child-in-care benefit because she is caring for children under the age of 16. A widow, any age, with a child younger than age 16, gets 75 percent of the worker’s benefit amount unless that amount exceeds the FMB.

However, if she chooses to take the benefit, she would:

Pay taxes on her amount

She would be subject to an earnings limit if she works outside the home

It would reduce her children's benefits based on the FMB

Since the kids' benefits already reach the FMB, why would Dedee want to take a child-in-care benefit that she has to pay taxes on which also limits her earning potential?

Her family will receive roughly the same amount whether she takes a benefit or not.

______________________________________________________________________________________

Now for a different scenario where it might be a good idea to take a child-in-care benefit, let's look at another fictitious family.

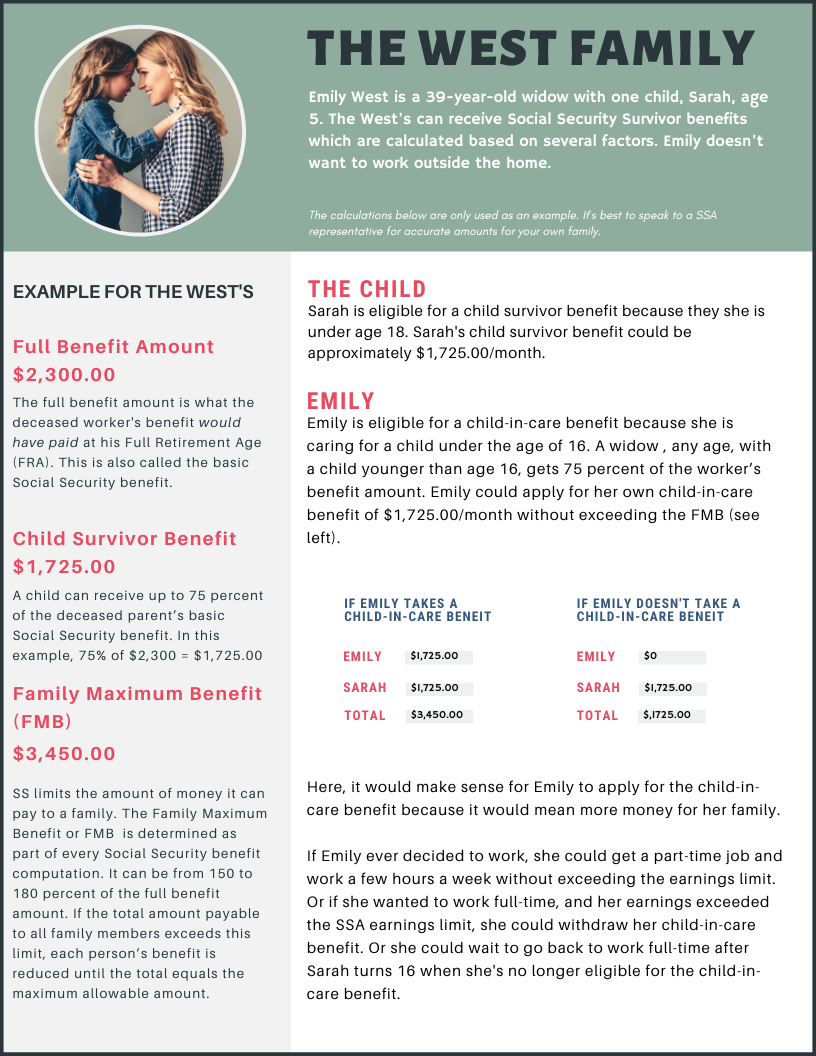

Emily West has one child, Sarah. She's just starting kindergarten and Emily doesn't want to work outside the home.

Her daughter could receive approximately $1,725.00/month in child survivor benefits. Emily could receive approximately $1,725.00 in child-in-care benefits. This will not exceed their FMB. In this case, it would make sense for Emily to apply for the child-in-care benefit because it would mean more money for her family.

Even though Emily wants to stay home with her daughter, she could still get a part-time job while Sarah is in school and work a few hours a week without exceeding the earnings limit. So, Emily could have both.

If Emily ever decided to go to work fulltime, and her earnings exceeded the SSA earnings limit, she could withdraw her child-in-care benefit. Or she could wait to go back to work fulltime after Sarah turns 16 when she's no longer eligible for the child-in-care benefit.

______________________________________________________________________________________

I know it can be complicated and the calculations are tricky, but you really have to take into consideration the following numbers:

What your FMB is

What your earning potential is outside the home

How long you'd be receiving the child-in-care benefit, because it ends when your youngest turns 16

Take a deep breath now.

This was a lot of info and you might still be confused.

That's OK.

Read this again.

And again if you need to.