Notify Credit Card Companies

You must contact the credit card companies to let them know about your spouse’s death and to cancel any credit cards in your spouse’s name. If you continue to use a credit card that belonged to the deceased, they could hold you criminally liable for the purchases.

In most cases, credit card debt is wiped clean after someone dies. But not always. See the lesson on Payment Liability for more information.

You can also ask the credit card representative if there are any additional cardholders listed. This could be an authorized user or a joint account holder. If other users are listed, contact them to let them know you’re closing the account.

There are a few things you need to do, however, before you close your spouse’s credit card accounts.

Keep track of credit card information

As you go about closing credit card accounts, record all the account information on one document.

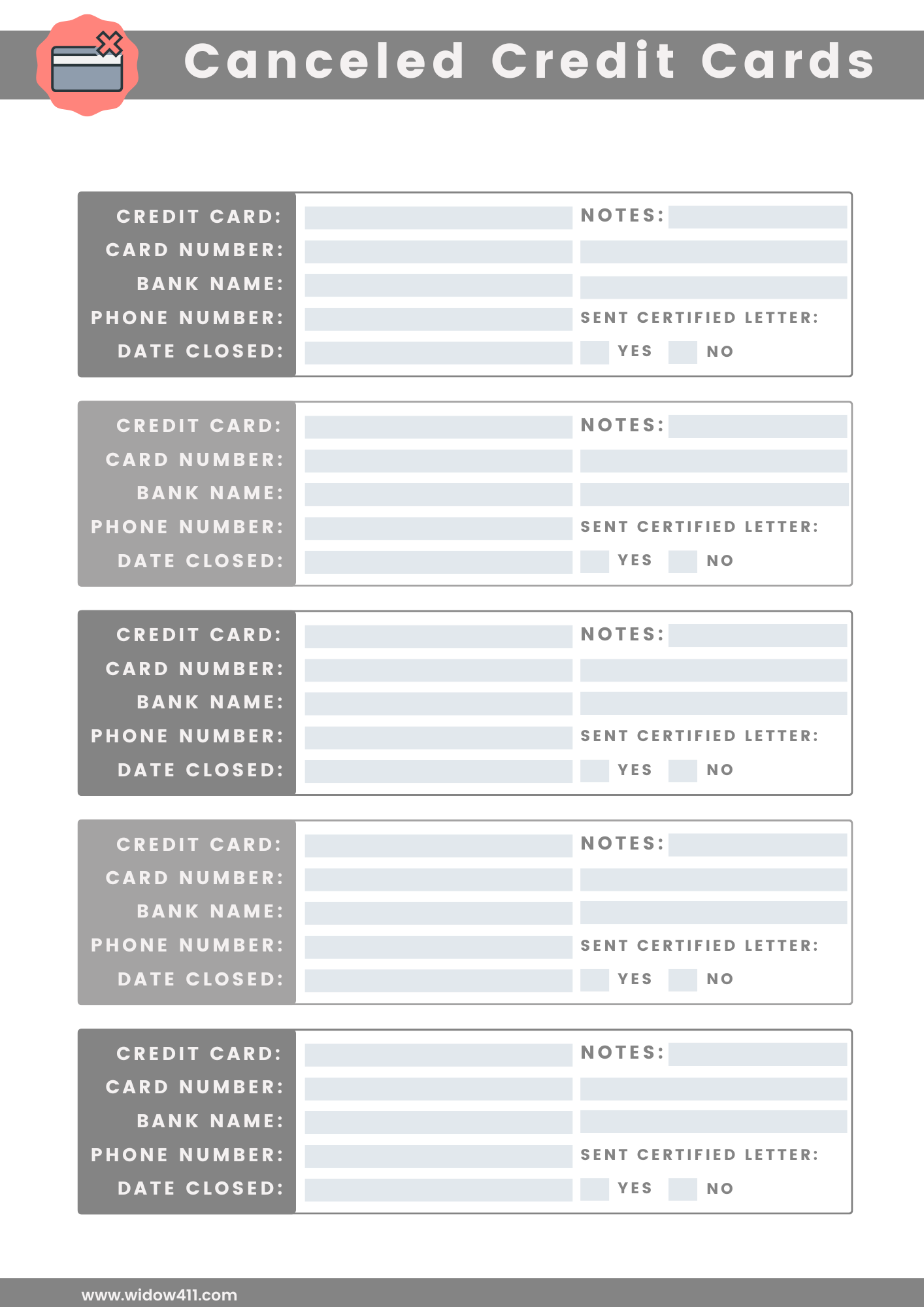

Use this Canceled Credit Cards worksheet to keep track of what credit card accounts were closed and when.

Download this worksheet and add it to your binder. You'll find this document under the Downloads section below.

This worksheet is editable which means you can enter/edit data right from your computer.

Or simply download, print, and fill out by hand.

Apply for credit in your name

If you were an authorized user on your spouse’s credit card, you no longer legally have access to use that card. You must apply for a credit card in your name only because any credit cards issued to your spouse are legally no longer valid.

It’s important to have a credit card in your name to establish or maintain credit anyway. A good credit history allows you to earn lower interest rates on loans and other credit cards, receive better car insurance rates, and get the best cell phone contract benefits to name a few.

If you are the primary cardholder on a current credit card, no sweat. You’re good to go because you’ve established credit in your name.

If you’re not a primary credit card holder, get a credit card in your name STAT.

Remove yourself (or spouse) as an authorized user

If you were an authorized user on your spouse’s credit card, it’s wise to remove yourself as an authorized user before you close the credit card account. Or if you spouse was an authorized user on your credit card, remove his name from your account.

Why?

To protect your credit score should something negative happen to your spouse’s credit report. If your spouse died with a credit card balance, you’re not responsible for repayment, but his credit score could be negatively impacted by the delayed payments. If you’re an authorized user on his card or he’s an authorized user on your card, it could affect your credit score, too.

To remove your name as an authorized user, call the credit card issuer BEFORE you cancel the credit card account and ask them to remove you from the account. Keep in mind, not every card issuer will allow you to remove your name as an authorized user. Some issuers require the primary credit card holder to make the call (which your spouse obviously can’t do) so if they won’t remove you, just cancel the card.

After you’re removed as an authorized user, you can complete the steps to cancel the credit card in its entirety.

If you’re the primary card holder, call the credit card company and ask that his name be removed as an authorized user.

Determine reward points before closing

Many credit cards offer reward points and/or cash back rewards. Before closing your spouse’s account, ask the representative if any credit card reward points exist. Points can be used for cash back, travel, shopping portals or catalog purchases.

If reward points do exist, determine whether it’s feasible to keep the card open until the points are redeemed. However, if the credit card has an annual fee that exceeds the value of redeemable points, consider closing the account and forgoing any redeemable points. It doesn’t make sense to pay a $95 annual fee, for example, if the redeemable points are only worth $45.

If the value of the reward points exceeds the annual fee, verify how long the reward points are valid and make sure to use them before they expire.

Report the death and cancel recurring charges

It is best to:

Call the credit card companies and report the death first

Cancel any recurring charges on the credit card

Follow-up with a written cancellation letter

The phone call flags the account owner as deceased, but the written letter, along with a copy of the death certificate, provides proof.

During the phone call, ask for the mailing address to send the follow-up letter. And ask the credit representative to identify and cancel any recurring charges on the card. This will stop any additional charges from registering on the credit card account.

Cancel credit card letter template

I created a letter template for you with the exact wording you need to request a credit card cancellation.

Download the blank/fillable Credit Card Death Notification template. Fill in the template with your own information and then print/send the completed copy.

Make a copy for your records and add it to your binder.

You'll find this document under the Downloads section below.

The following is an example of what a completed letter looks like.

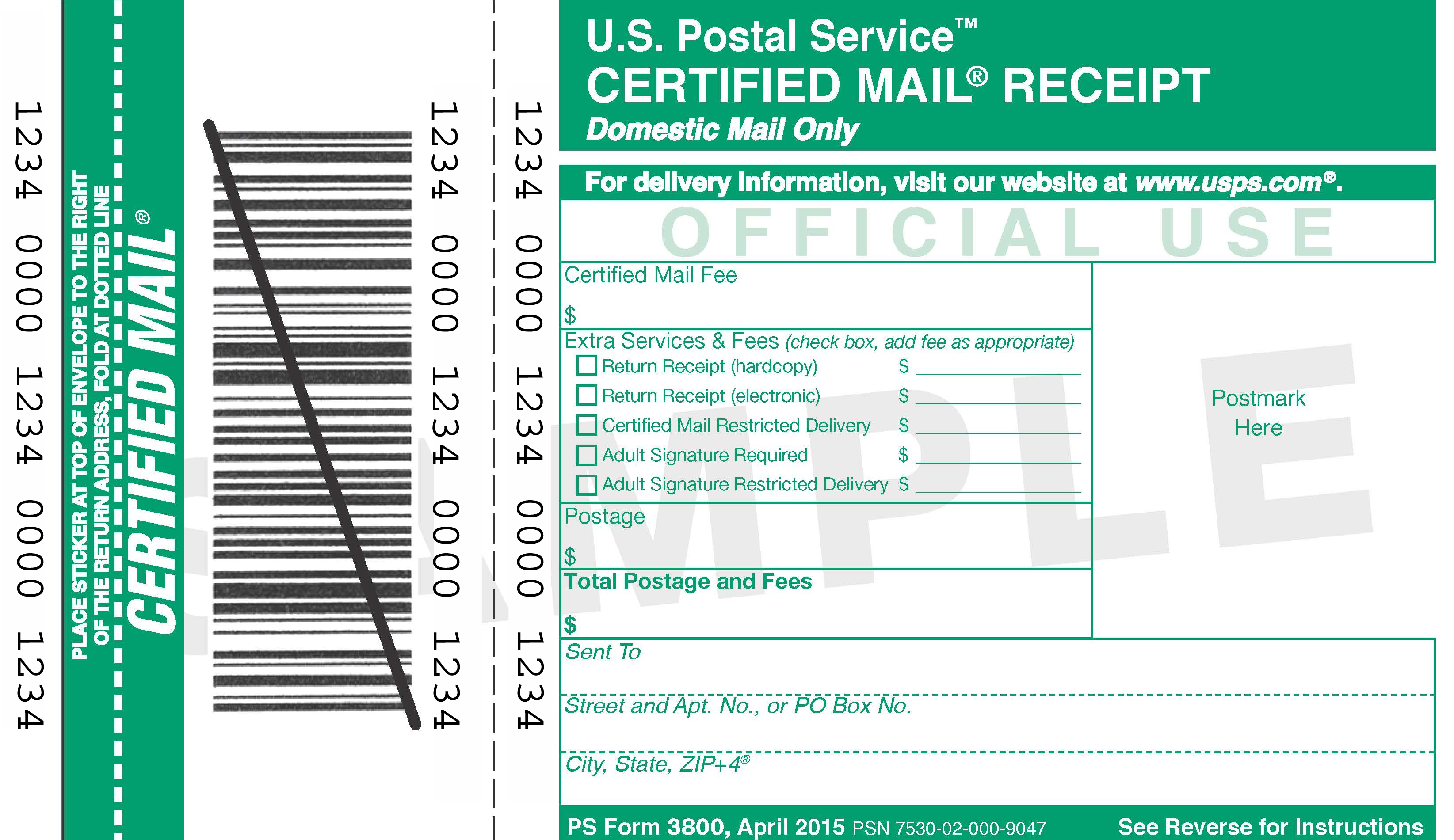

Send the letter Certified Mail

Be sure to send the letter certified mail. This gives you a receipt of your mailing and verification the letter was delivered.

Remember to make copies of the letter(s), include your certified mail receipts, and file in your binder under the “Account Management” section.

Cancel recurring charges with individual companies

Even if you canceled recurring charges on the credit card with the credit card account representative, it’s still a good idea to follow up with the individual companies and notify them you’ve canceled their recurring charges.

Add alerts to credit cards you keep open

I recommend adding alerts to your credit cards just like I recommend for your bank accounts.

A credit card alert notifies you when a specific trigger sets off an event in your account. Monitoring your credit card allows you to spot unusual transactions and cancel your credit card immediately if your card has been compromised.

At a minimum, I would recommend enabling the following suspicious activity alerts:

Card declined

Gasoline transaction

Online or phone transaction

International transaction

Credit limit reached

I have alerts on my credit cards and one night I received a text that my PNC bank credit card was used for a Lyft transaction in San Francisco. It obviously wasn’t me because I was at home watching TV - in Michigan. Besides, I’ve never used Lyft before.

My credit card was obviously compromised, so I cancelled the credit card right away. Within a total of about 15 minutes, I received the text, called PNC to report the stolen credit card and canceled it.

If I didn’t have credit card alerts set up, I wouldn’t have known about the fraudulent use until I received my bill and noticed the unusual transaction.

But by that time, who knows how many other transactions would’ve posted?

To set up credit card alerts, sign into your credit card account or download the card issuer app on your phone or. Look for a link to “preferences” or “settings.” Next, look for a link to “alerts” or “notifications.”

Finally, choose the alerts you want to receive.