Change Beneficiary Records

If your spouse was listed as a beneficiary on any of your accounts (bank, retirement, investment, etc.) you must update those accounts to list a new beneficiary.

You need to change beneficiary information on any account with a monetary designation such as:

Bank accounts (savings, checking, money market, CD)

Retirement Accounts (401 (k), IRA, Roth IRA, annuities)

Investments (Stocks, bonds, mutual funds, non-retirement accounts)

Health Savings Account (HSA)

Life Insurance

Because I don’t know what kinds of accounts you have, I can’t provide specific information on how to change your beneficiary designations.

However, a quick Google search or phone call to the institution/agency will outline the necessary steps to change your beneficiary designations for your specific accounts. Enter a Google search for “how do I change beneficiary name on (insert institution here) account” for instructions.

For example, if you have a Chase bank account, you can do a Google search for “change beneficiary name on Chase bank account.” If you can’t find the beneficiary change information online, call the customer service phone number and ask the representative for beneficiary name change instructions.

If your assets are in a trust, you need to follow the procedure for the specific type of trust you have. For example, a revocable living trust allows the flexibility to make changes to the trust terms whenever necessary. Whereas an irrevocable living trust cannot be revoked or changed.

Minor children shouldn’t be named beneficiaries

If your children are your new beneficiaries, you shouldn’t name them directly as beneficiaries if they are minors because minors cannot legally own assets.

This will force the court to appoint a conservator to act on your child’s behalf if the child is a named beneficiary and receives money.

The same applies to grandparents naming grandchildren as beneficiaries of their accounts. If grandma lists her minor grandchildren as beneficiaries on any accounts, the court will appoint a conservator to act on your child’s behalf even if you, the living parent, is willing and able to act.

With beneficiaries who are minors, it’s best to look into setting up a trust.

Also, as a reminder from Section 4, don’t add your children - minor or adult - to your house deed as a replacement for a beneficiary designation.

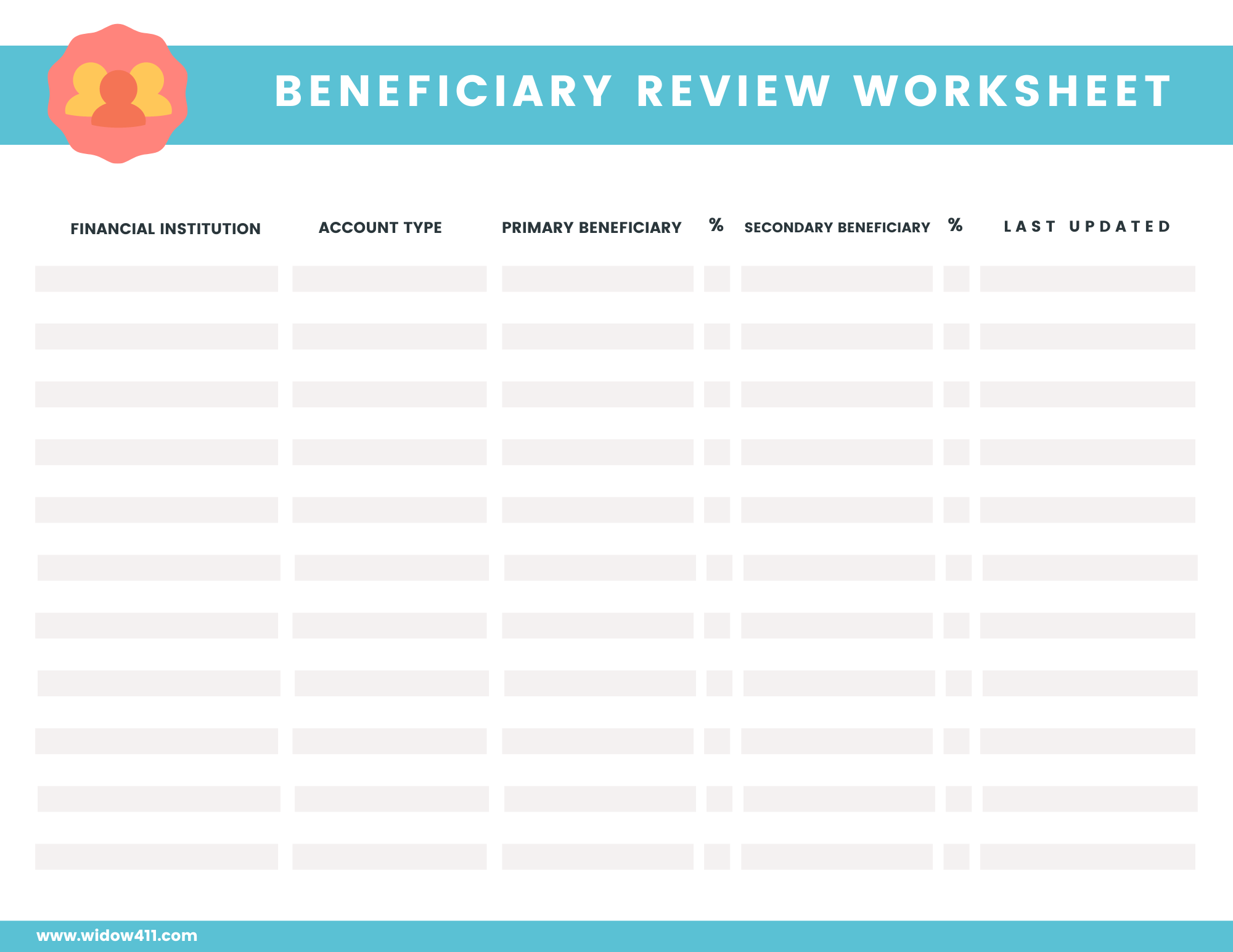

Beneficiary review worksheet

To help you keep track of your beneficiary designations for various accounts, I created a Beneficiary Review Worksheet.

Use this Beneficiary Review Worksheet to keep track of your beneficiaries on all of your financial accounts. Download this worksheet and add it to your binder.

You'll find this document under the Downloads section below.

This worksheet is editable which means you can enter/edit data right from your computer.

Or simply print it and fill out by hand.