Manage Bank Accounts

If you’re anything like my family, we had several accounts at different banks.

My husband had one bank for his business accounts and a different bank for our personal accounts, including our checking account. I had my own savings account at another bank.

All these accounts contributed to unnecessary confusion.

To keep everything organized in my fragile widow brain, I chose one bank and consolidated all my accounts. I closed bank accounts I no longer needed.

Truth be told, I didn’t like the bank my husband used for personal accounts. So, I closed those accounts first.

Now I have one bank with a business checking, personal savings, and personal checking account.

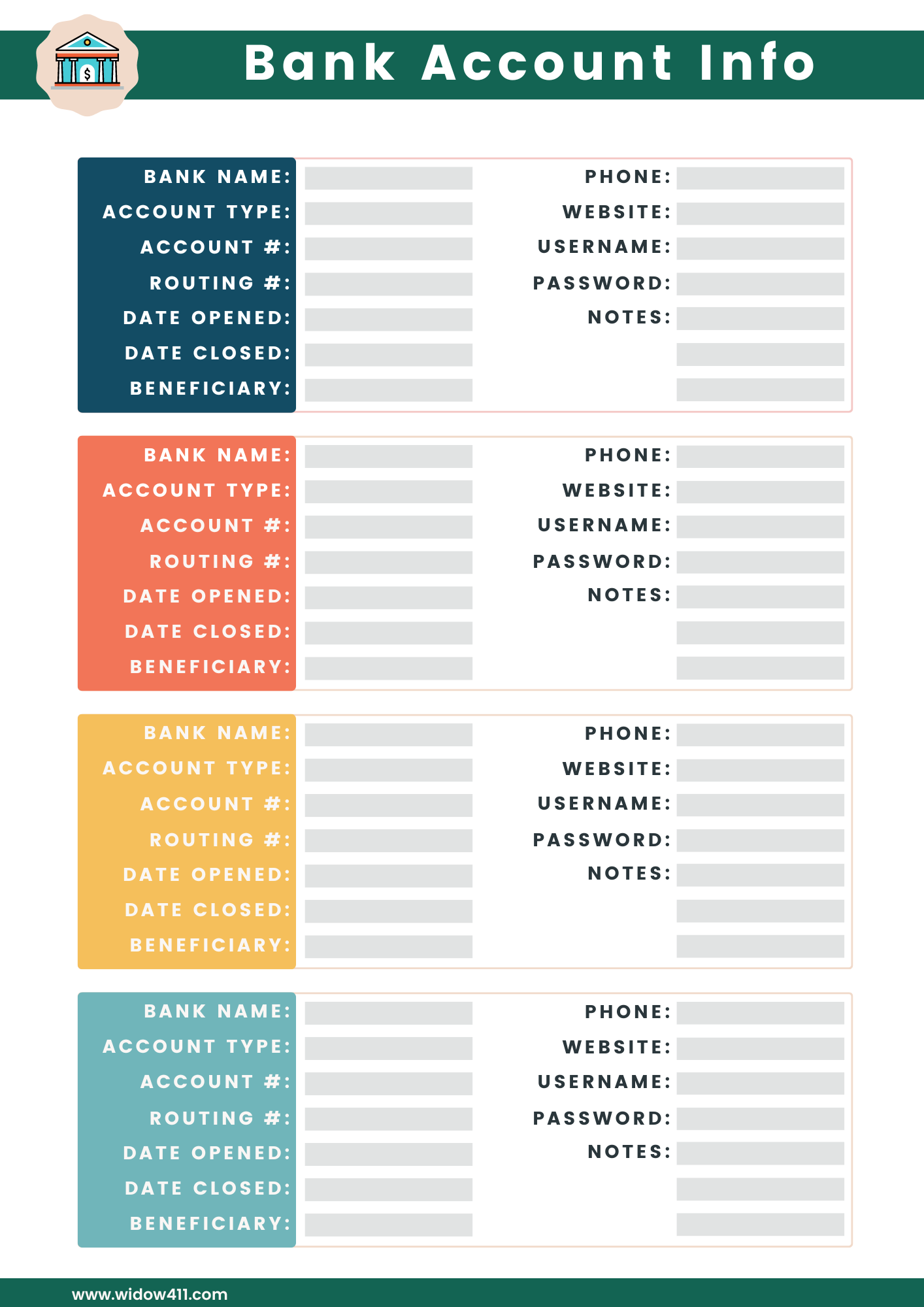

Keep track of bank account information

As you go about opening, closing, or transferring accounts, record all your bank account information on one document.

Use this Bank Account Info worksheet to keep track of your important account information, including account and routing numbers, plus open and close dates.

Download this worksheet and add it to your binder. You'll find this document under the Downloads section below.

This worksheet is editable, which means you can enter/edit data right from your computer. Or simply download, print, and fill out by hand.

Add alerts to your bank accounts

Now that you're solely responsible for your bank accounts, I recommend enabling alerts on your accounts to stay on top of all your bank transactions.

An alert notifies you when a specific trigger sets off an event in your account.

These alerts can either tell you when an important event happens like a direct deposit has arrived or when suspicious activity is going on in your account, like an account opening or closing. All alerts can be set up for either mobile banking apps and/or traditional accounts.

At a minimum, I would recommend enabling the following suspicious activity alerts:

ATM Cash Withdrawal Greater than $5 (or specify amount)

Transfer Greater Than $5 (or specify amount)

Wire Transfer Greater than $5 (or specify amount)

Pre-Authorized Payment Greater than $5

Overdraft

If a thief finds his way into your account and tries to withdraw, transfer or wire cash, you will be notified either via email or text (whichever way you choose when you set up an alert), and you can contact the bank immediately.

If you regularly withdraw cash from an ATM, you might want to increase the withdrawal amount alert. Or use the alert as a budgeting option to remind you how many times you withdraw cash.

You may not even realize how often you stop at the ATM for a quick $10 or $20 which adds up fast.

Make friends with your local banker

My husband knew everyone at the bank where he had his business accounts. He never went through the drive-thru to make deposits or cash checks. He always went inside and talked to the tellers face-to-face. They knew him personally.

After he died, I went into the same branch he always used and began transferring accounts to my name. Because they knew my husband so well, the process was painless.

That branch has since closed, but I make it a point to go into the branch I do business with now and talk to the tellers and managers. I use the drive-thru plenty, but I don’t rely on it for every transaction.

I’ve had to cash checks made out to my husband seven years after his death (IRS/business related) and if I didn’t have a relationship with the bank employees, I don’t think it would be as simple as it is now.

Keep joint checking account open for at least one year

If you have a joint checking account, it’s a good idea to keep the account, with your spouse’s name on it, open for at least a minimum of one year.

Any checks issued to your deceased spouse are easier to cash with an account that matches his name. If you didn’t have a joint checking account, just leave another account with his name on it open instead.